Loading

Get 2001state Tax Non Resident Iowa Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the infusion confirmation form online

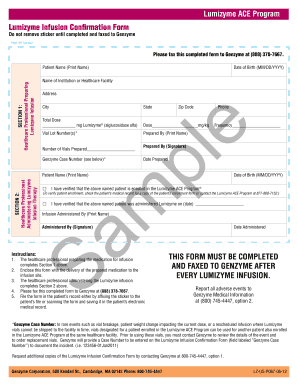

This guide provides clear and supportive instructions for filling out the infusion confirmation form online. By following the steps outlined below, users can ensure accurate completion and timely submission of the form.

Follow the steps to complete the infusion confirmation form.

- Click 'Get Form' button to obtain the infusion confirmation form and open it in the editor.

- Begin by entering the name of the healthcare institution or facility in the designated field.

- Fill out the address and state of the healthcare facility.

- Input the total dose of administered, recorded in milligrams (mg). Additionally, specify the dose per kilogram (mg/kg) in the specified field.

- Enter the vial lot number(s) for traceability and record keeping.

- Print your name in the 'Prepared By' section, confirming your role in preparing the medication.

- Indicate the total number of vials prepared for the infusion.

- Provide the patient’s name in the appropriate field.

- Detail the frequency of the infusions as applicable to the treatment plan.

- Record the date when the medication was prepared and the patient's date of birth in MM/DD/YYYY format.

- Verify patient enrollment in the ACE Program and note the verification method, whether by checking medical records or contacting the program directly.

- Specify the date on which was administered and the name of the healthcare professional administering the infusion.

- Ensure the administering professional signs in the designated signature field.

- Complete the sections related to the administering healthcare professional, including their name and birth date.

- Include the Genzyme Case Number if relevant, particularly for incidents that require tracking or replacement of vials.

- After filling out the form, fax the completed document to Genzyme at (888) 378-7667. Ensure that the form is either filed in patient records or appropriately stored in electronic medical records.

Complete your infusion confirmation form online today for accurate and efficient processing.

resident alien generally files the 1040NR form for federal tax purposes. However, for state taxes in Iowa, they must use the 2001state Tax Non Resident Iowa Form to report any income earned in the state. It is essential to be aware of both federal and state filing requirements, and tools like uslegalforms can assist in navigation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.