Loading

Get Missouri Form Mo Atc How To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Missouri Form Mo Atc How To online

Filling out the Missouri Form Mo Atc is an important step for adoptive parents seeking tax credits for adoption expenses. This guide will provide clear instructions to help users navigate the form efficiently online.

Follow the steps to complete the Missouri Form Mo Atc online.

- Click ‘Get Form’ button to locate the form and access it in the online editor.

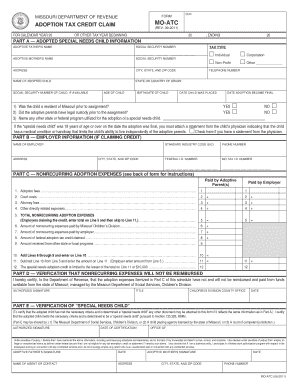

- Begin by entering the information of the adopted special needs child in Part A. This includes the child's name, age, birthdate, and details of their placement and adoption finalization.

- Provide the adoptive parents' names and social security numbers in the designated fields in Part A. Ensure that all information is accurate for tax claims.

- Answer the residency and legal custody questions in Part A by selecting 'Yes' or 'No' as appropriate.

- If applicable, attach a statement from the child's physician confirming their medical condition if the child was over 18 at the time the adoption became final.

- Move to Part B and complete the employer information section if the employer is claiming a credit. Fill in the name, industry code, and other requested details.

- In Part C, detail all nonrecurring adoption expenses. List each type of expense, such as adoption fees and attorney fees, in the corresponding fields.

- Calculate the total nonrecurring adoption expenses and enter this amount in Line 5 of Part C. Ensure all totals are accurate.

- Fill out the remaining lines in Part C, including any funds received from state or local programs and the federal adoption tax credit.

- Complete Part D by certifying that the expenses listed will not be reimbursed, signing, and dating where required.

- If necessary, finish with Part E to affirm the child’s status as a special needs child through certification.

- Review all parts of the form for completeness and accuracy, then save your changes. You can download, print, or share the form as needed.

Complete your Missouri Form Mo Atc online now for a smoother submission process.

Choosing the correct Missouri tax form depends on your specific tax situation. Common forms include the 1040 for individual income tax and the 1065 for partnerships. If you need help determining which form applies to you, sites like uslegalforms can provide guidance tailored to your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.