Loading

Get When Do Employees From The County Of Kern Get Their W2 Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FSA Reimbursement Request Form online

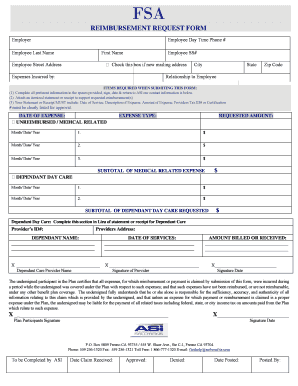

This guide provides user-friendly instructions on how to accurately complete the FSA Reimbursement Request Form for employees of the County of Kern. By following these steps, users can ensure that their reimbursement requests are processed efficiently.

Follow the steps to complete your reimbursement request form.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Fill in the employer information in the designated section. Ensure that the company's details are accurate.

- In the 'Expenses Incurred by' section, enter the city, state, and zip code where the incurred expenses took place.

- Attach the required documentation along with the form. This includes completing all pertinent information in the spaces provided, signing, dating, and returning the form to ASI. Remember to attach an itemized statement or receipt that includes the date of service, description of the expense, amount, and the provider’s tax ID number.

- Input the requested amounts for each incurred expense. Record each expense's month, date, and year along with their amounts. Calculate the subtotal for medical-related expenses and for dependent daycare, if applicable.

- Sign and date the form at the end to certify that the information provided is accurate and that no other plans will reimburse these expenses. Ensure that the signature fields are filled out correctly.

Complete your FSA Reimbursement Request Form online today for a seamless reimbursement process.

Yes, the IRS can provide a copy of your W-2 if you request it. You can file Form 4506-T to receive a transcript of your tax return, which includes your W-2 information. Remember, being aware of when employees from the County of Kern get their W-2 forms can save you time when you inquire about your documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.