Get State Of Hawaii Deferred Compensation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State of Hawaii Deferred Compensation online

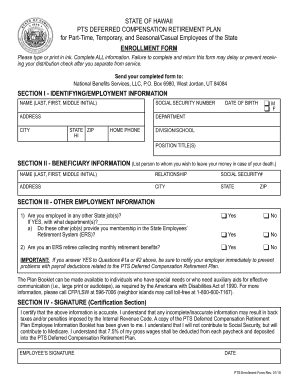

Filling out the State of Hawaii Deferred Compensation enrollment form can seem challenging, but this guide simplifies the process by breaking down each section. Whether you are a part-time, temporary, or seasonal employee, this step-by-step approach will help you complete the form accurately and efficiently.

Follow the steps to successfully complete your enrollment form.

- Click 'Get Form' button to obtain the form and open it in your preferred editor.

- In Section I, provide your identifying and employment information. This includes your name, social security number, address, home phone, date of birth, and your department and position title. Ensure all information is accurate and complete.

- Section II focuses on beneficiary information. List the name and relationship of the person you wish to designate as your beneficiary. Fill in their social security number and address for record-keeping.

- Proceed to Section III, where you need to disclose any other employment information. Answer the questions about whether you are employed in other State jobs or if you are an ERS retiree collecting benefits. Ensure to specify which department(s) you are associated with if applicable.

- In Section IV, sign and date the certification. This confirms that the information you provided is accurate. Understand that inaccuracies could lead to tax penalties.

- After completing all sections, review your form to ensure there are no mistakes. Once you are satisfied, you can save your changes, download, or print the form as needed for submission.

Complete your State of Hawaii Deferred Compensation enrollment form online today to ensure your financial future!

A hardship withdrawal from the State Of Hawaii Deferred Compensation plan allows you to access your savings in case of an immediate financial need. This type of withdrawal is designed to assist you during challenging times such as medical emergencies or natural disasters. It's important to understand that these withdrawals may have tax implications and can affect your retirement savings. Explore your options carefully before proceeding.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.