Loading

Get 565 K 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 565 K 1 online

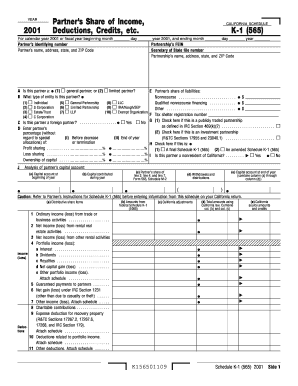

This guide provides a comprehensive overview of how to accurately fill out the Schedule K-1 (565) form online for California partnerships. By following these steps, users can ensure that they report their share of the partnership's income, deductions, and credits correctly.

Follow the steps to complete your Schedule K-1 (565) online.

- Press the ‘Get Form’ button to access the Schedule K-1 (565) form and open it in your online editor.

- Enter the year for which you are filing, indicating either the calendar year or the relevant fiscal year dates.

- Fill out the partner's identifying information, including their name, address, state, and ZIP code.

- Include the partnership's FEIN and Secretary of State file number along with the name and address of the partnership.

- Indicate whether the partner is a general partner or a limited partner by selecting the appropriate checkbox.

- Specify the type of entity to which the partner belongs, choosing from options such as individual, S corporation, estate/trust, C corporation, etc.

- If applicable, check the box to indicate if the partner is a foreign partner.

- Input the percentage allocations for profit sharing, loss sharing, and ownership of capital, noting both before decrease and end-of-year percentages.

- Complete the section regarding the partner’s share of liabilities, including nonrecourse and qualified nonrecourse financing.

- Fill in the relevant income, deductions, and credits as indicated in the provided lines, ensuring to adhere to the California adjustments.

- Once all fields are accurately completed, save your changes, and choose to download, print, or share the filled-out form.

Begin filling out your Schedule K-1 (565) online today to ensure accurate reporting of your partnership income and credits.

You can obtain a K-1 by requesting it from the partnership entity in which you hold a stake. The partnership will issue you a K-1, which details your share of the income, deductions, and credits. It's important to make this request timely to ensure you receive it before tax season and can file correctly with your CA 565.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.