Get California K 1 541 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the California K 1 541 Form online

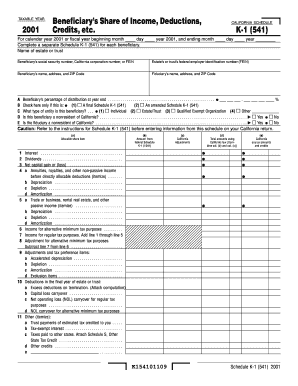

The California K 1 541 Form is a critical document used by estates and trusts to report a beneficiary's share of income, deductions, and credits. This guide provides clear, step-by-step instructions on filling out this form online, ensuring users can complete it accurately and efficiently.

Follow the steps to complete the California K 1 541 Form online

- Click ‘Get Form’ button to access the California K 1 541 Form. This action will allow you to open the document in a digital format, ready for your input.

- Begin by entering the taxable year for which you are reporting. This is typically the year the estate or trust was active, which you will specify in the provided field.

- Fill in the name of the estate or trust, along with the corresponding federal employer identification number (FEIN). Make sure these details are correctly aligned with official records.

- Provide the beneficiary’s social security number, California corporation number, or FEIN in the designated fields. Ensure this information is accurate to prevent any future complications.

- Complete the beneficiary’s name, address, and ZIP code, taking care to enter it clearly to avoid any miscommunication.

- Indicate the percentage of distribution the beneficiary is entitled to at year-end. Enter this percentage in the appropriate section, ensuring it is precise.

- Answer the questions regarding whether the beneficiary or fiduciary is a nonresident of California by checking 'Yes' or 'No' as applicable. This will help in determining correct tax implications.

- Proceed to fill out the sections under allocable share items by providing the necessary financial figures from the federal Schedule K-1 (1041) into the form’s appropriate columns.

- Double-check all entries to ensure that there are no mistakes or omissions that could lead to a penalty or delay in processing.

- Once all fields are completed and reviewed, you can save any changes made to the form. Afterwards, download, print, or share the completed document as necessary.

Start filling out the California K 1 541 Form online today for a smooth filing experience.

The California exit tax applies to individuals who move out of the state and claim a capital gain on the sale of property located in California. This tax affects those who have realized gains because they remain liable for California taxes on that income. If you're considering relocating, it's vital to understand your tax obligations, including those involving the California K 1 541 Form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.