Get Nd Form 38 2012 K 1

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Nd Form 38 2012 K 1 online

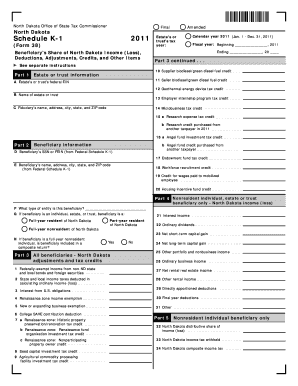

The Nd Form 38 2012 K 1 is a crucial document for estate or trust beneficiaries in North Dakota, detailing their share of income, losses, deductions, and credits. This guide will provide comprehensive and user-friendly instructions to help you fill out this form online.

Follow the steps to complete the Nd Form 38 2012 K 1 online.

- Press the ‘Get Form’ button to access the Nd Form 38 2012 K 1 and open it in your preferred online form editor.

- Enter the estate's or trust's federal employer identification number (EIN) in the designated field.

- Provide the name of the estate or trust in the corresponding section.

- Fill in the fiduciary's name, address, city, state, and ZIP code.

- Complete the Beneficiary information section by providing your social security number (SSN) or federal employer identification number (FEIN) and your full name, address, city, state, and ZIP code.

- In Part 4, indicate the residency status of the beneficiary, whether they are a full-year resident, part-year resident, or full-year nonresident of North Dakota.

- For nonresident beneficiaries, ensure all North Dakota income, gains, losses, and deductions are accurately reported in the specified fields.

- Proceed to Part 3, ensuring that all North Dakota adjustments and tax credits are filled out as applicable based on your income sources.

- Complete any additional sections as necessary, based on your specific situation and the information provided by the fiduciary.

- Once all information is accurately entered, you can save changes, download, print, or share the filled-out form as needed.

Complete your Nd Form 38 2012 K 1 online today to ensure accurate reporting of your income and tax obligations.

To file a K-1 form, begin by gathering the necessary information from your partnership or S corporation. Complete the Nd Form 38 2012 K 1 with accurate figures from your tax documents. Finally, submit the completed form along with your personal tax return. Utilizing platforms like US Legal Forms can simplify this process, ensuring that you have the correct format and guidance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.