Get Form 50-114, Residence Homestead Exemption Application - Texas...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 50-114, Residence Homestead Exemption Application - Texas online

Filling out the Form 50-114 online can streamline the process of claiming your residence homestead exemption for property taxes in Texas. This guide provides you with clear, step-by-step instructions to help you successfully complete each section of the form online.

Follow the steps to efficiently complete your exemption application.

- Press the ‘Get Form’ button to access the Form 50-114 and open it in an online editor.

- Begin by entering your name and contact information in the designated fields at the top of the form. Make sure to include your phone number and current mailing address.

- Describe your property in the appropriate section. Include the street address, legal description if no street address is available, and any relevant property account number. Additionally, indicate the number of acres used for residential occupancy, ensuring it does not exceed 20 acres.

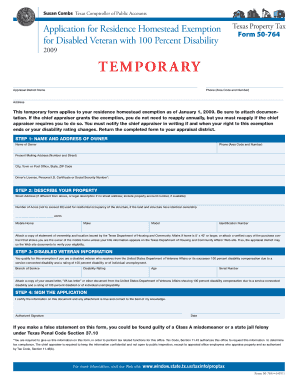

- Provide your disabled veteran information if applicable. Fill out the branch of service, disability rating, age, and serial number. Attach any required documentation that verifies your 100 percent disability compensation.

- Review all entered information for accuracy. Ensure that all necessary attachments are included, as incomplete submissions may delay your application.

- Sign the application to certify that the information provided is true and correct to the best of your knowledge. Enter the date of signature.

- Once all fields are complete, you can choose to save your changes, download the form, print it for mailing, or share it, as needed.

Complete your residence homestead exemption application online today for a seamless filing experience.

Related links form

The 50-114 form is the Residence Homestead Exemption Application used in Texas. It allows homeowners to claim a homestead exemption, which can decrease their property taxes. By submitting this form, you can qualify for potential savings, so make use of US Legal Forms to access this essential document with ease.

Fill Form 50-114, Residence Homestead Exemption Application - Texas...

GENERAL INFORMATION: Property owners applying for a residence homestead exemption file this form and supporting documentation with the appraisal district in. When filing for the residence homestead exemptions, you must file an application no later than two years after the delinquency date. No information is available for this page. This document must be filed with the appraisal district office in the county in which your property is located. Do not file this document. I am applying for a residence homestead exemption. This is the form to fill out if you want a General Residence Homestead Exemption,. Person Age 65 or Older Exemption, Disabled Person Exemption, 100 Percent. GENERAL INSTRUCTIONS This application is for use in claiming residence homestead exemptions pursuant to Tax Code Sections 11.13, 11.131, 11.132,. You can use Texas Comptroller Form 50114 to apply for the General Homestead Exemption.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.