Get Alabama Form K Rcc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alabama Form K Rcc online

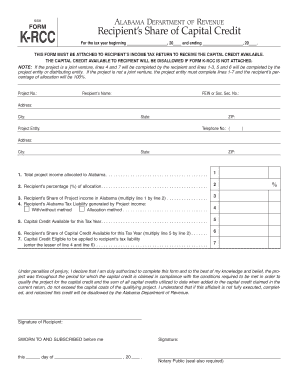

Filling out the Alabama Form K Rcc online is an essential step for recipients seeking to claim their share of capital credits effectively. This guide will walk you through each section of the form, ensuring a clear and comprehensive understanding of the process.

Follow the steps to complete the form accurately and efficiently.

- Use the ‘Get Form’ button to access and open the Alabama Form K Rcc in your online editor.

- Begin by entering the tax year details at the top of the form, specifying the start and end dates.

- Complete the project number and recipient's name, providing the FEIN or Social Security number.

- Fill in the address fields including street address, city, state, and ZIP code for the recipient.

- Enter the project entity's name and contact information in the designated sections.

- For line 1, provide the total project income allocated to Alabama.

- On line 2, indicate the recipient's percentage of allocation.

- Calculate the recipient’s share of project income in Alabama for line 3 by multiplying line 1 by line 2.

- Determine the recipient's Alabama tax liability generated by project income on line 4 using either the with/without method or the allocation method.

- Complete lines 5 and 6 to determine capital credits available for the tax year and the recipient’s share of them, respectively.

- On line 7, enter the lesser of line 4 and line 6 to finalize the capital credit eligible to be applied.

- Sign the form and complete the notary section, ensuring all information is accurate and complete.

- After filling out the form, save your changes and proceed to download, print, or share the completed form as needed.

Start completing your Alabama Form K Rcc online today to ensure you receive the capital credits available to you.

You can obtain Alabama state tax forms directly from the Alabama Department of Revenue’s website, where forms are available for download. Alternatively, you can visit local offices or request forms by mail if needed. For specific forms related to business taxes, such as the Alabama Form K Rcc, be sure to check the website frequently, as updates may occur throughout the tax year.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.