Get Mw506r Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mw506r Form online

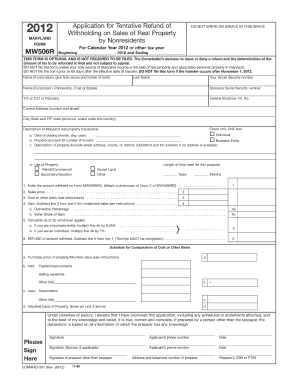

Filling out the Mw506r Form online is a straightforward process that allows users to apply for a tentative refund of withholding on sales of real property by nonresidents. This guide will provide step-by-step instructions to ensure accuracy and completeness in your application.

Follow the steps to complete your Mw506r Form online effectively.

- Click ‘Get Form’ button to obtain the Mw506r Form and open it in your online editor.

- Enter the applicable tax year at the top of Form Mw506r, ensuring it corresponds with the seller's transfer year.

- Fill in the name and address of the transferor/seller, and include their identification number (social security number or federal employer identification number).

- Check the appropriate box to indicate whether the transaction was conducted by an individual or a business entity.

- Provide the date of closing, the property account ID number (if known), and a thorough description of the property being sold, including its location.

- Indicate the current use of the property by selecting from the given options such as rental, commercial, or other, and specify the length of time it has been used for that purpose.

- Complete the sections for amounts withheld on Form MW506NRS, sales price, and cost or other basis as guided by the instructions.

- Calculate the gain by subtracting the cost or other basis from the sales price, and enter the values in the respective fields.

- Depending on whether you are filing as a business entity or individual, follow the instructions to compute any applicable refund amounts.

- Review all entries for accuracy, finalize your application by signing where indicated, and include any necessary documentation.

- Once completed, save your changes, and choose options to download, print, or share the form as needed.

Start your Mw506r Form application online now to ensure timely processing.

CA form 593 is filled out by individuals selling real estate in California to report the amount of withholding tax. It's typically completed by sellers or their agents during property transactions. Understanding this form is essential for proper tax reporting and compliance. While this form pertains primarily to California, keeping your MW506R Form in mind may help you understand the withholding processes better.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.