Loading

Get Form 13287 Bank Payment Problem Identification - Irs

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 13287 Bank Payment Problem Identification - IRS online

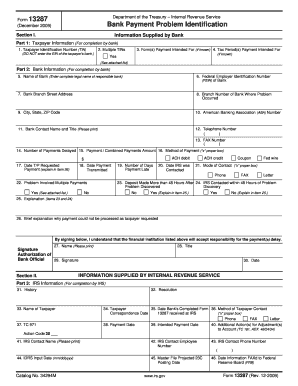

Form 13287 is used to identify bank payment problems related to taxpayer payments to the IRS. This guide provides thorough instructions on how to accurately complete this form online, ensuring clarity and support throughout the process.

Follow the steps to successfully complete the Form 13287.

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

- In Section I, Part 1, provide the taxpayer information. Enter the Taxpayer Identification Number (TIN) without entering the EIN of the taxpayer's bank. If there are multiple TINs involved, indicate this and attach a list with their respective details.

- Still in Part 1, fill in the forms that the payment was intended for and the tax periods if known.

- Move to Part 2 and complete the bank information section. Enter the complete legal name of the responsible bank and its Federal Employer Identification Number (FEIN). Provide the branch address and other contact details including name, title, and phone number of the bank representative.

- Specify the number of payments delayed and the total payment amounts. Indicate the method of payment, and provide the date the taxpayer requested payment and the date it was transmitted.

- Document the number of days the payment is late and when the IRS was contacted. Select the mode of contact and address whether the problem involved multiple payments.

- Provide a brief explanation regarding why the payment could not be processed as requested. You must sign and date the form as the bank official, indicating acceptance of responsibility for the delay.

- Once all sections are completed and verified, save changes to the form. You may download, print, or share it as necessary to submit to the IRS.

Complete your Form 13287 online today to resolve any bank payment issues effectively.

Resolving an issue with the IRS involves contacting their support or visiting their website for guidance. Clearly explain your issue, and have all necessary documentation ready. If the problem relates to banking issues, reference the Form 13287 Bank Payment Problem Identification - IRS for solutions tailored to such scenarios. Being prepared helps streamline the resolution process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.