Loading

Get Form 1223

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1223 online

Filling out Form 1223 online can be a straightforward process when you have clear guidance. This step-by-step guide will help you navigate through each section of the form and ensure that you provide the necessary information accurately.

Follow the steps to successfully complete Form 1223 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

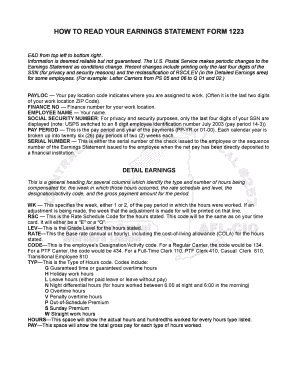

- Review the section titled 'E&D,' where you'll find important information related to your earnings statement. Ensure that your details, such as your employee name and pay location code, are accurately reflected.

- In the 'Detailed Earnings' section, fill in the specifics for each pay type. Include the week number in which the hours were worked, the Rate Schedule Code (RSC), Grade Level (LEV), and Base Rate. Be careful to fill in the actual hours worked and the total gross pay for those hours.

- Complete the 'Gross to Net' section by ensuring that all deductions, such as federal tax, state tax, and retirement contributions, are accurately calculated. Verify your taxable status and have your exemptions noted next to the respective fields.

- In the 'Leave Status' area, provide details regarding your annual leave and sick leave balances for the pay period. Input the number of hours you have carried over, earned, used, and your current balance.

- Fill out the 'Bond Data' section, indicating any current bonds, unpaid bonds, and the number of bonds issued during the pay period.

- As a final step, review all the information provided to ensure accuracy. You can then save the changes, download, print, or share the completed form as required.

Complete your Form 1223 online today for a hassle-free process!

Yes, you are required to fill out a customs declaration form when entering Canada. This requirement helps border officials assess your goods. Utilizing tools like US Legal Forms can clarify the process and ensure proper completion of your Form 1223.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.