Loading

Get It 2104p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IT-2104P online

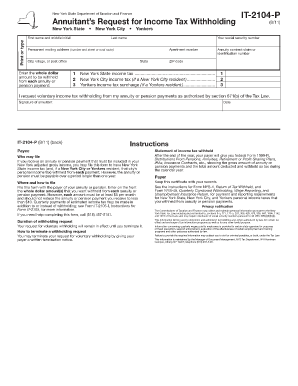

The IT-2104P form allows individuals receiving annuity or pension payments to request voluntary income tax withholding. This guide provides a clear, step-by-step approach to completing the form online, ensuring users can easily navigate the process.

Follow the steps to complete the IT-2104P form accurately.

- Click the ‘Get Form’ button to access the IT-2104P form and open it in the editor.

- Enter your first name and middle initial, followed by your last name in the appropriate fields. Ensure the accuracy of the names provided.

- Input your Social Security number in the designated section to establish your identity for tax withholding.

- Provide your permanent mailing address, including the number and street or PO Box, apartment number, city or village, state, and ZIP code.

- Specify your annuity contract claim or identification number to reference your pension plan correctly.

- In section 1, enter the amount you wish to withhold for New York State income tax from each annuity or pension payment.

- If you are a resident of New York City, complete section 2 with the desired amount for New York City income tax withholding. If applicable, fill in section 3 for Yonkers income tax surcharge based on residency.

- Indicate your request for voluntary income tax withholding by checking the appropriate box or entering the specified amount in the relevant fields.

- Sign the form as the annuitant and date it to validate your request for withholding.

- Once all fields are accurately filled, save your changes, and consider downloading or printing the completed form for your records.

- Submit the signed IT-2104P form to the payer of your annuity or pension to initiate your request for withholding.

Complete your IT-2104P form online today to ensure proper tax withholding.

To generate a withholding tax slip, you typically can access your employer's payroll system or contact your HR department. This slip outlines your income and the taxes withheld throughout the year. It's essential for completing your tax returns accurately. For an efficient process, consider the user-friendly templates and resources available on uslegalforms to streamline your tax preparation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.