Loading

Get Imrf Form 6 21

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Imrf Form 6 21 online

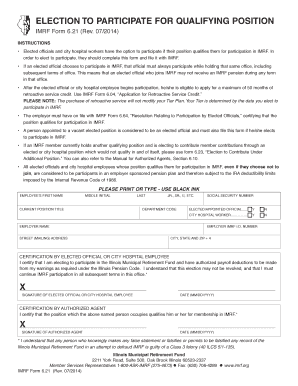

Filling out the Imrf Form 6 21 online is a straightforward process that allows elected officials and city hospital workers to elect participation in the Illinois Municipal Retirement Fund. This guide provides detailed, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the form online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering your personal information in the required fields: first name, middle initial, last name, and suffix (if applicable). Use black ink if you are completing the form offline.

- Fill in your current position title, department code, and social security number in the provided spaces. Ensure that you enter your social security number correctly.

- Indicate your status by selecting 'Yes' or 'No' for the questions regarding whether you are an elected/appended official and a city hospital worker.

- Provide your employer name, mailing address, and employer IMRF identification number. Double-check the accuracy of the information entered.

- In the certification section, confirm your election to participate in the IMRF by signing and dating the form. Your signature must be your own.

- If applicable, have the authorized agent sign and date the certification, confirming that your position qualifies for membership in IMRF.

- After completing all sections, review the entire form for accuracy and completeness. Save your changes, download, print, or share the completed form as needed.

Complete your Imrf Form 6 21 online today to secure your participation in the Illinois Municipal Retirement Fund.

Yes, IMRF provides a death benefit for eligible members. This benefit can support your beneficiaries financially in the event of your passing. It's advisable to review the IMRF Form 6 21 for full details on eligibility and the specific amount your beneficiaries would receive.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.