Get Terminate W 4 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Terminate W 4 Form online

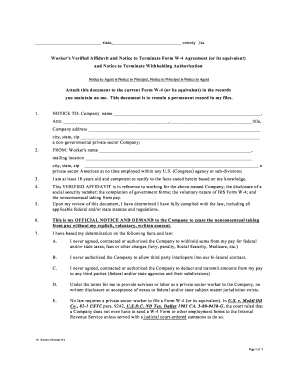

Completing the Terminate W 4 Form online is essential for individuals wishing to officially terminate withholding authorization with their employer. This guide provides step-by-step instructions to help you navigate the process effectively.

Follow the steps to complete the Terminate W 4 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In the 'NOTICE TO' section, provide the name of the company, the attention recipient, and their title, as well as the company’s address including city, state, and zip code.

- In the 'FROM' section, enter your name and mailing address, ensuring to include the city, state, and zip code.

- Confirm your age and competency in the statement provided, affirming that you can testify to the facts stated.

- In the VERIFIED AFFIDAVIT section, specify your position regarding the withholding of your pay, ensuring it reflects your understanding and stance.

- List the grounds for your notice, clearly indicating that you never authorized the withholding of taxes and highlight any applicable facts or laws to support your claims.

- Review the statement of 'non-covered worker' status and affirm its accuracy based on your personal tax situation.

- Sign and date the form at the bottom, acknowledging that you have read and understand the document.

- If required, visit a notary public to have your signature acknowledged, ensuring to fill out the notary section properly.

- Once completed, save your changes, and decide whether to download, print, or share the form with your employer.

Complete your Terminate W 4 Form online today to ensure your withholding authorization is officially terminated.

To fill out a W-4 form for the biggest refund, consider claiming 0 allowances, which maximizes the withholding amount from your paycheck. This strategy often results in a larger refund when you file your taxes. However, ensure this aligns with your overall financial strategy and doesn't lead to financial strain throughout the year. Regularly review your W-4 and make adjustments as necessary to optimize withholding while effectively managing your tax return process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.