Get Nh Department Of Revenue Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the nh department of revenue form online

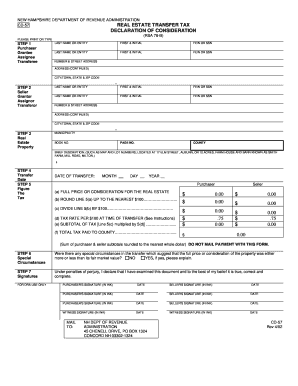

This guide provides a clear and supportive overview of how to complete the New Hampshire Department of Revenue Form CD-57, also known as the transfer tax declaration of consideration. By following these instructions, users can efficiently fill out the form online to ensure compliance with state regulations.

Follow the steps to complete the nh department of revenue form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the purchaser's full name and address in the fields provided. Include the social security number or federal employer identification number for each purchaser. If there are more than three purchasers, please attach a supplemental schedule.

- Provide the seller's full name and address in the designated fields. Like the purchasers, include their social security number or federal employer identification number, and attach a supplemental schedule if necessary.

- Specify the property details by entering the municipality, book number, and page number along with a brief description of the property in the appropriate space. Include any necessary information such as map and lot numbers.

- Input the date of transfer, ensuring it is correct. Then proceed to complete the tax calculation. Begin by entering the total full price or consideration for the real estate in line 5(a). Round this amount up to the nearest $100 in line 5(b).

- Divide the amount from line 5(b) by 100 to complete line 5(c). Next, enter the applicable tax rate for the transfer in line 5(d), based on the current rate at the time of transfer.

- Calculate the subtotal tax for both purchaser and seller by multiplying the amounts in lines 5(c) and 5(d) for each in line 5(e). In line 5(f), sum the subtotal taxes for both parties, rounding to the nearest whole dollar, but do not send tax payment with this form.

- Check for special circumstances regarding the property transfer in step 6. Indicate if the full price or consideration is either more or less than its fair market value, providing an explanation if applicable.

- Complete the form by securing the necessary signatures. Both purchasers and sellers must sign in ink, including the date and witness signatures in the spaces provided.

- Once all sections are completed and signed, review the document for accuracy. Lastly, save changes, and download, print, or share the form as needed.

Complete your nh department of revenue forms online for a seamless filing experience.

You can get NH tax forms from the NH Department of Revenue’s website, which houses all necessary documents for filing. This online resource eliminates the hassle of paper submissions while providing access to all the NH Department Of Revenue Forms you might need. It is essential to check this site regularly to stay updated with any changes in forms or regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.