Loading

Get St Louis Form E 11

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the St Louis Form E 11 online

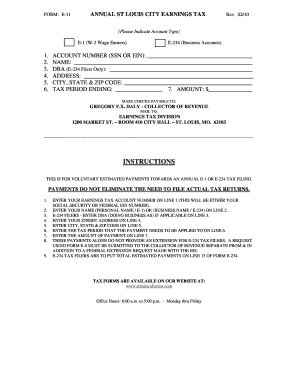

Filling out the St Louis Form E 11 online can be a straightforward process with the right guidance. This form is used for making voluntary estimated payments towards an annual earnings tax for both individuals and businesses. This guide will walk you through each section, ensuring a smooth completion.

Follow the steps to fill out the St Louis Form E 11 online.

- Click the 'Get Form' button to obtain the form and access it in the online editor.

- Indicate the account type by selecting either E-1 for W-2 wage earners or E-234 for business accounts.

- Enter your earnings tax account number on line 1, which will be either your social security number or federal EIN.

- Input your name on line 2; if you are filing as an individual, use your personal name, or enter your business name if you are filing under E-234.

- For E-234 filers, provide your DBA (doing business as) name on line 3, if applicable.

- Fill in your street address on line 4.

- Complete line 5 with your city, state, and zip code.

- Enter the tax period ending on line 6, specifying the applicable time frame for the payment.

- Specify the amount of payment on line 7.

- Review your entries for accuracy. Ensure all necessary fields are completed.

- Proceed to save changes, then download, print, or share the form as needed.

Start filling out the St Louis Form E 11 online today to ensure timely payments.

Yes, Missouri requires residents and non-residents who earn income in the state to file a tax return. This obligation includes reporting any earnings taxable at the state and city levels. To ensure you're in compliance, utilizing resources like St Louis Form E 11 can guide you through the filing requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.