Get Sc 1120s - Sctax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC 1120S - Sctax online

Filing your SC 1120S - Sctax form online can streamline the process and ensure that your information is submitted accurately. This guide will walk you through each section of the form, providing step-by-step instructions to facilitate your completion of this important tax return.

Follow the steps to fill out the SC 1120S form online efficiently.

- Press the ‘Get Form’ button to access the SC 1120S - Sctax form and open it in your preferred editor.

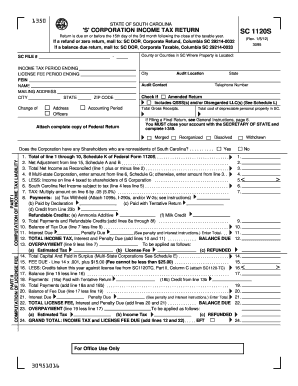

- Input your SC file number, income tax period ending date, and license fee period ending date in the respective fields. Ensure that all provided information is accurate and up to date.

- Provide your Federal Employer Identification Number (FEIN), the name of your corporation, and your mailing address, including city, state, and ZIP code.

- Indicate if there is a change of address or any changes in corporate officers. Update the required sections accordingly.

- Fill out the section regarding the counties in South Carolina where your property is located. Include the city and any contact information you're required to provide.

- Attach a complete copy of your Federal Return to the form as instructed.

- Complete Part I for the computation of income tax liability. This includes gathering total gross receipts and total costs of depreciable property in South Carolina. Be sure to report any income taxed to shareholders.

- Transition to Part II for calculating the license fee. Here, you will compute the total of your capital and paid-in surplus, ensuring that calculations are accurate and in compliance with state regulations.

- Review all entries for accuracy and completeness. Ensure that all required attachments are included before proceeding.

- Once completed, save your changes, and you can download, print, or share the SC 1120S - Sctax form as needed.

Complete your SC 1120S - Sctax form online today for a more efficient filing experience.

Related links form

You do not file your S Corp and personal taxes together; however, the S Corp income will be included on your personal tax return. This means you will report the profits and losses of your S Corp on Schedule E of your Form 1040. For a smooth filing process, it's essential to properly complete Form SC 1120S - Sctax and understand how it integrates with your personal tax situation. If you need help managing this, uslegalforms offers resources to simplify the process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.