Get Spencer County Kentucky Net Profit License Fee Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Spencer County Kentucky Net Profit License Fee Return online

Completing the Spencer County Kentucky Net Profit License Fee Return is an essential process for businesses operating in the region. This guide aims to provide you with clear and comprehensive steps to complete the form online, ensuring that you have all the necessary information at your fingertips.

Follow the steps to successfully complete your return online.

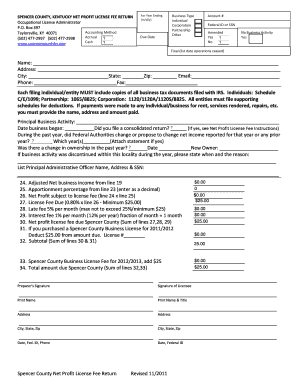

- Press the ‘Get Form’ button to access the form and open it in the designated online editor.

- Enter the year ending in the specified field. This represents the fiscal year for which you are reporting your net profit.

- Select the appropriate due date for submitting your return. This is typically based on the local filing schedule.

- Indicate the type of business by checking the corresponding option: Individual, Corporation, Partnership, or Other.

- Input your account number and Federal ID or Social Security Number in the provided fields.

- Specify if this return is amended by selecting ‘Yes’ or ‘No’.

- Indicate if there was no business activity by checking ‘Yes’ or ‘No.’ If applicable, provide the date operations ceased in the final field.

- Fill in your business name, address, city, state, and zip code. Ensure accuracy to avoid processing delays.

- Complete contact information by providing your email, phone number, and fax number.

- Include copies of all relevant business tax documents filed with the IRS, depending on your business structure.

- Detail your principal business activity and the date your business began operations.

- Respond to inquiries regarding any federal changes to income or ownership changes in the past year, providing details where required.

- Fill out the adjusted net business income by using the designated lines and calculations provided in the form.

- Calculate your net profit subject to the license fee based on the provided formulas using the appropriate lines from the form.

- Determine the total license fee due, including any applicable late fees or interest fees, ensuring you adhere to local regulations.

- If you purchased a Spencer County Business License for the previous year, deduct that amount as specified.

- Finalize your totals by summing relevant lines to determine the total amount due for the current period.

- Provide the signature of the licensee, and print the preparer's name and title as required.

- Save your changes, and you can choose to download, print, or share the completed form as needed.

Complete your Spencer County Net Profit License Fee Return online today to ensure your business remains compliant.

The occupational tax in Winchester, KY, varies based on income and is imposed on both individuals and businesses operating within the city. This tax supports local services and infrastructure. To ensure you meet your obligations under the Spencer County Kentucky Net Profit License Fee Return, it may be helpful to consult uslegalforms. Our platform can guide you through the requirements and forms necessary for compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.