Loading

Get 2007 Form Cbt 100

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form Cbt 100 online

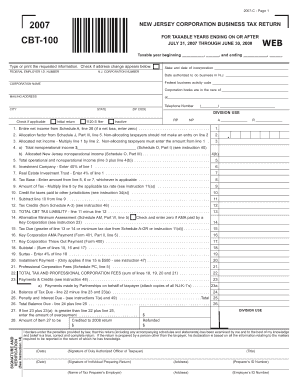

Filling out the 2007 Form Cbt 100 online can streamline your tax submission process and ensure accuracy. This comprehensive guide provides step-by-step instructions tailored for users with varying levels of experience, guiding you through each section of the form to facilitate a smooth filing experience.

Follow the steps to complete your tax return accurately.

- Click the ‘Get Form’ button to obtain the form and open it in an online editor.

- Complete the taxable year information by entering the starting and ending dates for the corporation's tax period. Ensure to enter the correct Federal Employer Identification Number.

- Fill out the corporation's details, including the name and mailing address. Confirm the incorporation date and New Jersey Corporation Number.

- Indicate if any changes have been made to the address by checking the appropriate box.

- Enter the entire net income on line 1 as per Schedule A. If this is a net loss, input zero.

- Provide the allocation factor from Schedule J, and compute the allocated net income by multiplying line 1 by the allocation factor.

- Report nonoperational income and calculate the total operational and nonoperational income on line 5.

- Determine the tax base by entering the applicable amount found in line 5, 6, or 7.

- Calculate the amount of tax due by applying the appropriate tax rate to the tax base entered in line 8.

- Subtract any credits for taxes paid to other jurisdictions listed in line 10 and finalize the total tax liability at line 13.

- Review and ensure that all sections are complete, then save, download, print, or share your completed form.

Ensure to complete your 2007 Form Cbt 100 online accurately and submit it before the deadline!

To amend the NJ CBT-100, you need to complete the appropriate amendment form and provide updated information. If you made an error or need to change reported figures related to the 2007 Form Cbt 100, this process is manageable. The US Legal Forms platform offers resources and forms that simplify this amendment process for you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.