Loading

Get Form 7004 - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 7004 - Internal Revenue Service - IRS online

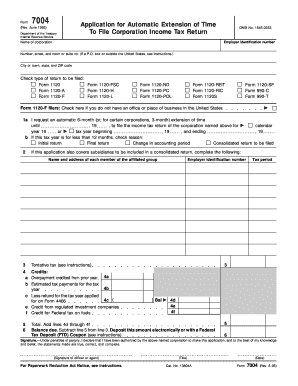

Filing Form 7004 is a necessary step for corporations seeking an automatic extension of time to file their income tax return. This guide provides clear, step-by-step instructions to successfully complete the form online.

Follow the steps to complete Form 7004 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the name of the corporation as it appears on official documents in the designated field.

- Enter the employer identification number (EIN) assigned to the corporation, ensuring accuracy for proper processing.

- Fill in the number, street, and room or suite number where the corporation is located. If applicable, use the P.O. box instead.

- Specify the city or town, state, and ZIP code accurately to avoid any miscommunication.

- Select the type of return to be filed by checking the appropriate box among the options provided.

- In line 1a, request an automatic 6-month or 3-month extension and enter the correct extension date, ensuring it is not later than 6 months from the original due date.

- If the tax year is shorter than 12 months, check the reason in line 1b and provide any necessary details.

- If applicable, list the name and address of each member of an affiliated group in line 2.

- Calculate and enter the tentative tax amount in line 3, reducing it by any credits and ensuring it reflects the corporation's tax situation.

- In line 6, indicate any balance due and prepare to make the necessary payment electronically or via a Federal Tax Deposit, as applicable.

- Scroll to the signature section, where the authorized person may sign and date the form, verifying the information is accurate.

- After completing the form, save your changes, and you may download, print, or share the form as needed.

Complete your Form 7004 online today to ensure a timely extension for your corporation's tax filing.

You can eFile an extension through several reputable tax preparation platforms, including the IRS website and software like TurboTax and H&R Block. These services offer user-friendly experiences and ensure you correctly complete Form 7004 - Internal Revenue Service - Irs. Utilizing these platforms simplifies the process, so you can focus on other important aspects of your tax preparation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.