Get Va 4p

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Va 4p online

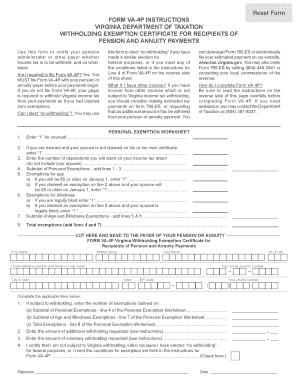

The Virginia withholding exemption certificate for recipients of pension and annuity payments, known as Form VA-4P, is essential for notifying your pension administrator about your income tax withholding preferences. This guide will help you navigate the process of completing Form VA-4P online with clarity and ease.

Follow the steps to complete Form VA-4P online.

- Press the ‘Get Form’ button to access the online version of Form VA-4P and open it in your preferred editor.

- Begin by entering your personal information, including your first name, middle name, last name, address, social security number, city or town, state, and ZIP code.

- Next, complete the personal exemption worksheet. Enter '1' for yourself on line 1, and if applicable, enter '1' for your spouse on line 2. For line 3, input the number of dependents you will claim on your income tax return, excluding your spouse.

- Calculate the subtotal of personal exemptions by adding lines 1 to 3, and record the total on line 4.

- Check if you qualify for additional exemptions for age or blindness. Enter '1' for each exemption you qualify for based on your age or blindness in lines 5 and 6. Total these exemptions on line 7.

- Calculate the total exemptions by adding the subtotal of personal exemptions from line 4 and the subtotal from line 7. Enter this amount on line 8.

- If subject to withholding, enter the number of personal exemptions claimed on the applicable lines. Indicate any additional withholding amount you would like on lines 2 and 3, if applicable.

- If you wish to elect 'no withholding,' check the box on line 4 and ensure you meet the necessary conditions outlined in the form.

- Finally, review all entered information for accuracy before signing and dating the form. Cut along the line indicated to separate the completed form from the rest of the document.

- Submit the completed Form VA-4P to your pension or annuity payer.

Start completing your Form VA-4P online today to ensure your income tax withholding preferences are accurately reported.

Filling out form VA-4 is straightforward. You need to provide personal information such as your filing status, the number of allowances you're claiming, and any additional withholding amounts. For guidance, using services like USLegalForms can simplify the process and help ensure accuracy when completing your VA 4P.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.