Loading

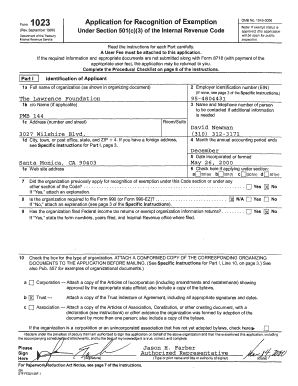

Get Form 1023 - The Lawrence Foundation - Thelawrencefoundation

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1023 - The Lawrence Foundation - Thelawrencefoundation online

Filling out the Form 1023 is an important step for organizations seeking tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This guide provides clear and concise instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the form online successfully.

- Press the ‘Get Form’ button to access the application and open it in the editor for completion.

- Fill in Part I, which includes the identification of the applicant. Provide the full name of the organization, employer identification number (if applicable), address, and contact information for the representative person. Ensure that all details match the organizing documents.

- In Part II, detail the organization's activities and operational information. Describe each activity, its purpose, when it was initiated, and who will conduct the activity. Include sources of financial support and any fundraising initiatives.

- Complete Part III, which involves answering questions regarding technical requirements. Indicate if the application is being filed within the required timeline and address any exceptions noted.

- Fill out Part IV with the organization's financial data. This includes the statement of revenues and expenses, as well as the balance sheet. Ensure that all figures are accurate and reflect the organization’s financial status.

- Review the completed form for accuracy. Ensure all required attachments, such as the organizing documents and any necessary schedules, are included before submission.

- Save your changes, then download, print, or share the completed form as necessary. Ensure that the application is sent to the appropriate address as per the instructions provided.

Start filling out your Form 1023 online now to secure your organization's tax-exempt status.

Organizations must electronically file this form to apply for recognition of exemption from federal income tax under section 501(c)(3). Note. You may be eligible to file Form 1023-EZ, a streamlined version of the application for recognition of tax exemption.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.