Loading

Get Form W-7a (rev. November 2003 ) - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form W-7A (Rev. November 2003) - IRS online

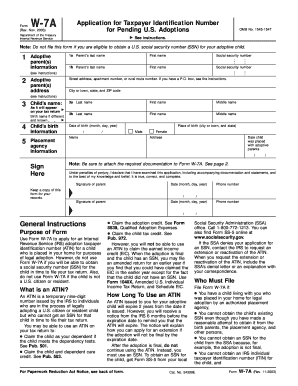

Filling out Form W-7A is an essential step for adoptive parents seeking a taxpayer identification number for a child placed in their home for adoption. This guide provides clear, step-by-step instructions to help you successfully complete this form online.

Follow the steps to fill out Form W-7A accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing software.

- In section 1, provide the names and Social Security numbers of the adoptive parent(s). Ensure to enter the primary adoptive parent's details on line 1a and the second parent's on line 1b.

- In section 2, enter the address where you and the child reside. If applicable, include your P.O. box number. Be sure to fill in the city, state, and ZIP code.

- For section 3, provide the child's adoptive name in field 3a as it will be used on your tax return. If available, enter the child's birth name in field 3b.

- In section 4, fill in the child's date of birth and sex. If known, include the child's place of birth as well.

- In section 5, add the name and address of the authorized placement agency that facilitated the child's placement with you for adoption. Also, include the date when the child was placed.

- At the bottom of the form, both adoptive parents must sign and date the application. It is critical that both parents' signatures are included if applicable.

- After completing all sections, ensure to gather and attach the required documentation that proves the child's placement for legal adoption, as specified in the instructions.

- Finally, file your completed Form W-7A by mailing it to the IRS address provided in the form's instructions. Keep a copy of the completed form for your records.

Start filling out your Form W-7A online today!

Related links form

Typically, you can retrieve tax returns for up to three years from the IRS. However, certain situations allow retrieval for up to six years. Checking your eligibility early on, especially if Form W-7A (Rev. November 2003) - Irs is involved, can prevent delays.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.