Loading

Get E 234

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the E 234 online

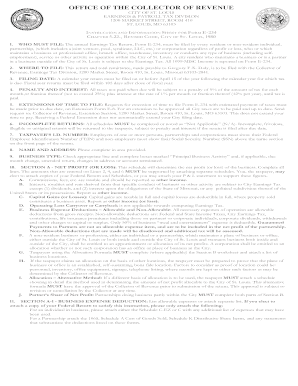

Filling out the E 234 form is essential for individuals, partnerships, and corporations that maintain a business presence in the City of St. Louis. This comprehensive guide provides step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the E 234 form online.

- Press the ‘Get Form’ button to obtain the E 234 form and open it for editing.

- Fill in your taxpayer identification information at the top of the form, including your Federal Employer Identification Number or Social Security Number.

- Provide your name and address in the designated fields.

- Indicate the type of business you are engaged in by checking the appropriate box and detailing the principal business activity.

- Complete Section A - Net Profit (or Loss) by entering applicable amounts. Ensure that Lines 2, 4, and 6 are backed by separate schedules.

- In Section A-1, detail your business expense deductions. You may attach your Federal Return to support your claims, but be selective about the information you provide.

- If you're claiming deductions in Section A-2, complete it accurately by listing payments made and their corresponding details.

- If applicable, fill out the Section B worksheet for business allocation of taxable net profit, ensuring you understand the regulations surrounding apportionment.

- Calculate your tax in Section C, entering figures from the previous sections to determine the total tax owed.

- Make sure to complete the signature section at the bottom of the return, ensuring legibility for all parties involved.

- After reviewing your form for completeness and accuracy, you can save changes, download, print, or share the form as needed.

Complete your E 234 form online today to ensure compliance and avoid penalties.

The number 234 in WhatsApp typically relates to contacts from Nigeria. When you see this code, it informs you that the caller or message sender is based in Nigeria. Keeping E 234 in mind can help you recognize and manage conversations effectively. Always ensure the legitimacy of contacts to ensure a safe communication experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.