Loading

Get Qms Loans

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Qms Loans online

This guide provides a step-by-step approach to filling out the Qms Loans form online. It is designed to assist users of all experience levels in completing the necessary fields accurately and efficiently.

Follow the steps to fill out the Qms Loans form online effectively.

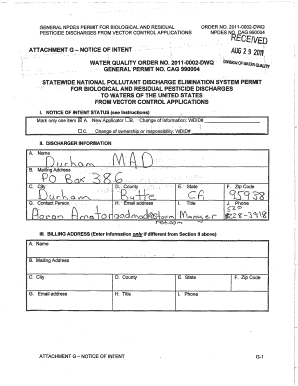

- Click the ‘Get Form’ button to access the Qms Loans document and open it for editing.

- Provide your name in the designated field, ensuring it matches your official ID.

- Enter your contact information, including your address, email, and phone number accurately.

- Fill in the billing address only if it differs from your contact information.

- Complete the sections regarding the discharger information, including the county and state.

- Answer the questions in the receiving water information section by marking all applicable items.

- Detail the pesticide application information, including the target organisms and types of pesticides used.

- Indicate the period of application with start and end dates.

- Confirm whether a pesticides application plan has been prepared and its familiarity.

- Complete the notification section regarding governmental agencies notification.

- Include the payment of the filing fee if you are a first-time enrollee.

- Certify the document by providing your printed name, signature, title, and date.

- Once completed, save your changes, download a copy, print it, or share it as necessary.

Start filling out your Qms Loans form online today for a smooth submission process.

Typically, non-qualified mortgages (Qms Loans) may come with higher interest rates compared to conventional loans. Lenders view these loans as higher risk due to their flexible terms and borrower qualifications. However, it’s important to evaluate your overall financial situation and long-term goals. USLegalForms can help you navigate these options and find the best solution that fits your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.