Loading

Get Form 1028

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 1028 online

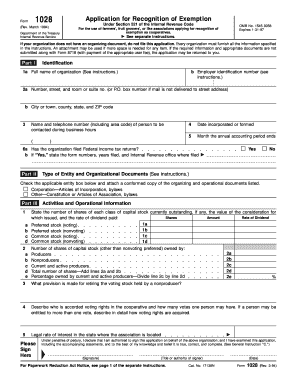

Filling out Form 1028 is an essential step for organizations seeking recognition of exemption under Section 521 of the Internal Revenue Code. This guide will help you navigate the online process with ease, ensuring that all required sections are completed accurately.

Follow the steps to successfully complete Form 1028 online.

- Press the ‘Get Form’ button to access the form and open it in your browser.

- Begin with Part I, which includes identification details. Enter the full name of your organization, followed by its employer identification number, address, and contact information for a representative.

- Complete Part II by selecting the type of entity your organization is and attaching the required organizing and operational documents.

- In Part III, provide detailed information regarding your organization’s activities. This includes the types and values of shares, voting rights, and any patronage dividends, as well as descriptions of your operational practices.

- Proceed to list the financial data in Part IV. Enter receipts and expenditures for the current year and the three preceding years, ensuring that all calculations are accurate and supported by attached schedules if necessary.

- Review all entered information for accuracy and completeness. If needed, make adjustments or add additional documentation.

- Once you have finalized the form, you can save your changes, download a copy for your records, print the form, or share it with relevant parties.

Start filling out your Form 1028 online today to streamline your application process.

Yes, Form W-4R is generally required if you are receiving pension payments or certain types of annuity payments. While it does not have a direct correlation with Form 1028, knowing your tax withholding responsibilities is important for effective financial planning. Platforms like uslegalforms provide resources to help you comply with such requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.