Get Wt7 Wisconsin 2009 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Wt7 Wisconsin 2009 Form online

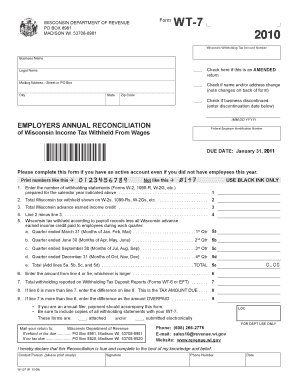

Completing the Wt7 Wisconsin 2009 Form online is an essential task for employers in Wisconsin to reconcile the income tax withheld from wages. This guide provides clear, step-by-step instructions to assist you in accurately filling out the form and ensuring compliance with state requirements.

Follow the steps to successfully complete the Wt7 Wisconsin 2009 Form online.

- Click ‘Get Form’ button to access the Wt7 Wisconsin 2009 Form and open it in your selected online tool.

- Begin by entering the number of withholding statements you prepared for the specified calendar year in the first field. This includes forms such as W-2, 1099-R, and W-2G.

- In the second field, input the total Wisconsin tax withheld as indicated on the W-2s, 1099-Rs, and W-2Gs.

- Complete the third field by entering the total Wisconsin advance earned income credit for the year.

- Subtract the amount from line 3 from line 2 and enter the result in line 4.

- Fill in the tax withheld according to payroll records for each quarter in the designated fields (5a through 5d), providing the data for each quarter’s tax withheld.

- Add the amounts from 5a, 5b, 5c, and 5d to determine the total in field 5e.

- In line 6, enter the larger amount from line 4 or 5e, which represents your total tax withheld.

- Record the total withholding from your Withholding Tax Deposit Reports (Forms WT-6 or EFT) in line 7.

- Calculate the difference by entering it in line 8 if line 6 exceeds line 7, indicating the tax amount due.

- If line 7 is greater than line 6, input the difference as an overpayment in line 9.

- Ensure all information is accurate, especially the contact person’s name, signature, phone number, and date in the provided area.

- After completing the form, save the changes, and choose to download, print, or share the form as necessary.

Start completing the Wt7 Wisconsin 2009 Form online today to ensure timely and accurate filing.

A sales tax clearance certificate in Wisconsin verifies that a business has fulfilled all its tax obligations. This certificate is essential for businesses seeking to transfer ownership or participate in specific transactions. To obtain this certificate, you may need to ensure proper filing of the Wt7 Wisconsin 2009 Form and related tax documents. It demonstrates your responsible tax practices and aids in smoother business operations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.