Loading

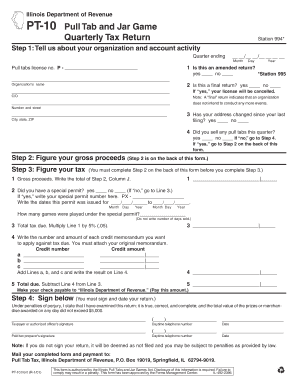

Get Pt - 10 Pull Tab And Jar Game Quarterly Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PT - 10 Pull Tab and Jar Game Quarterly Tax Return online

This guide provides clear and comprehensive instructions for completing the PT - 10 Pull Tab and Jar Game Quarterly Tax Return online. Follow each step carefully to ensure accurate filing and compliance with tax regulations.

Follow the steps to successfully complete the PT - 10 form online.

- Click ‘Get Form’ button to access the PT - 10 Pull Tab and Jar Game Quarterly Tax Return and open it in your preferred editing tool.

- Enter the ending date of the quarter for which you are reporting in the format MM/DD/YYYY.

- Indicate whether this is an amended return by checking 'yes' or 'no'.

- Provide your pull tabs license number in the designated field.

- Insert your organization's name and address. Confirm whether there has been an address change since your last filing.

- Answer if this is a final return. If 'yes', it means your license will be cancelled.

- Answer whether you sold any pull tabs during the reporting quarter. If 'yes', proceed to Step 2; if 'no', continue to Step 4.

- On the back of the form, complete Step 2 to calculate your gross proceeds by filling in the required columns A through L.

- Return to the front of the form to complete Step 3, calculating the total tax due by multiplying the gross proceeds by 5%.

- Document any credit memorandums you wish to apply against your tax due, attaching original memoranda as necessary.

- Determine the total amount due by subtracting any credits from your total tax due.

- Sign and date your return, ensuring you include your daytime telephone number.

- Mail the completed form and payment to the designated address provided.

Complete your PT - 10 Pull Tab and Jar Game Quarterly Tax Return online today for efficient processing.

A quarterly payment schedule refers to the timeline set by the IRS for submitting estimated tax payments four times a year. If you're involved in activities like the PT - 10 Pull Tab And Jar Game Quarterly Tax Return, it's crucial to understand when these payments are due to avoid penalties. Staying on top of this schedule can ease your tax season stress.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.