Loading

Get Penalty Waiver Request

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Penalty Waiver Request online

Filing a Penalty Waiver Request online can be a straightforward process with the right guidance. This guide will walk you through each section of the form to ensure you provide all necessary information for consideration.

Follow the steps to complete your request effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

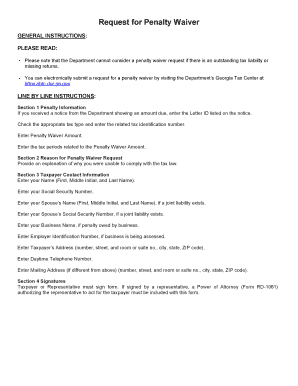

- In Section 1, enter the Letter ID listed on your notice if available. Select the appropriate tax type from the options provided, including Individual Income Tax, Sales and Use Tax, Withholding Tax, Corporate Income Tax, IFTA Fuel Tax, or specify 'Other'. Enter the related identification number based on the selected tax type and specify the Penalty Waiver Amount along with the tax periods associated with that amount.

- In Section 2, provide a detailed explanation for your request. Outline the circumstances that led to your inability to comply with tax regulations, ensuring you use the space provided. You may attach any supporting documentation that reinforces your explanation.

- Move to Section 3 where you will input your personal details. Fill in your Name (First, Middle Initial, Last Name) and Social Security Number. If applicable, enter your Spouse’s Name and Social Security Number for joint liabilities. If the penalty pertains to a business, include the Business Name and Employer Identification Number. Also, provide your Taxpayer’s Address including street details, city, state, and ZIP code, as well as a Daytime Telephone Number. If your mailing address differs, include that information as well.

- In Section 4, ensure that either the Taxpayer or their Representative signs the form. If a Representative is signing, include the necessary Power of Attorney form. Confirm the completion of the form, ensuring that no information is missing, and that everything is truthful.

- Once everything is completed, you can save your changes, download your form, print it for postal submission, or share it as needed ensuring you mail it to the specified Georgia Department of Revenue address.

Take the next step and complete your documents online today!

To get the CRA to waive interest and penalties, you should submit a well-crafted Penalty Waiver Request that clearly states your reasons. Provide details about any extenuating circumstances and attach necessary documentation to support your claim. It’s vital to remain compliant and prompt in addressing any issues to enhance the likelihood of a positive response.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.