Get Etf Form 4307

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Etf Form 4307 online

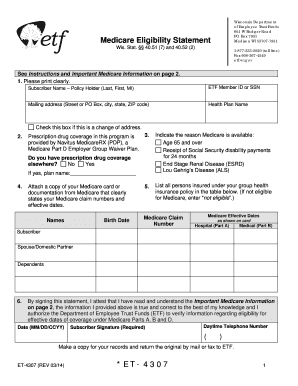

This guide provides clear instructions on how to complete the Etf Form 4307, a Medicare eligibility statement. By following these steps, users can efficiently fill out and submit the form online, ensuring that all necessary information is provided accurately.

Follow the steps to complete the Etf Form 4307 online:

- Press the ‘Get Form’ button to access the Etf Form 4307 and open it in your online editor.

- Clearly print the subscriber's name, including the last name, first name, and middle initial.

- Enter the subscriber’s eight-digit ETF Member ID or their full Social Security number.

- Provide the current mailing address, including the street or PO Box, city, state, and ZIP code.

- Indicate the health plan name the subscriber currently holds.

- If this is a change of address, check the corresponding box.

- Indicate the reason Medicare is available by selecting one of the options: Age 65 and over, receipt of Social Security disability payments for 24 months, End Stage Renal Disease (ESRD), or Lou Gehrig’s Disease (ALS).

- Complete the table listing all insured individuals under the group health insurance policy, including their names, birth dates, Medicare claim numbers, and effective dates.

- Check if you have prescription drug coverage elsewhere. If yes, provide the plan name.

- Attach a copy of the Medicare card or documentation indicating the Medicare claim numbers and effective dates.

- The subscriber must sign and date the form, providing their daytime telephone number.

- Once all fields are completed, save your changes. You can then download, print, or share the completed form.

Begin completing the Etf Form 4307 online today to ensure your Medicare eligibility is processed smoothly.

Get form

To avoid paying taxes on an ETF, consider strategies such as holding your ETF in a tax-advantaged account. Additionally, using the Etf Form 4307 can help you keep track of any potential losses that may offset your gains. It's advisable to familiarize yourself with tax regulations and consult a tax advisor if needed. Platforms like USLegalForms can offer invaluable resources for understanding these strategies.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.