Loading

Get Form 5121 Missouri

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 5121 Missouri online

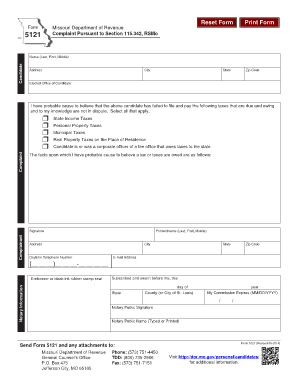

Filling out Form 5121 Missouri is an essential process for lodging a complaint against a candidate regarding their tax obligations. This guide will help you navigate through each section of the form, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the Form 5121 online

- Use the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin by entering the candidate's name in the designated fields. Ensure you include their last, first, and middle name as required.

- Next, input the candidate's address, including the city, state, and zip code.

- Indicate the elected office of the candidate by selecting the relevant option provided.

- In the 'Complaint' section, select all applicable tax types that you believe the candidate has failed to file, such as state income taxes or personal property taxes.

- Provide a detailed account of the facts that led you to believe a tax or taxes are owed. Use the space provided to outline your reasoning clearly.

- Complete the complainant section by signing the form, printing your name, and providing your address and contact information, including a daytime telephone number and email address.

- Fill out the notary information, ensuring your signature is notarized properly to validate your complaint.

- Once all fields are completed, review your form for accuracy. After confirming that all information is correct, you can save your changes, download the form, print it, or share it as needed.

Start filing your Form 5121 online today to ensure your complaints are processed promptly.

To acquire a certificate of tax clearance in Missouri, file the Form 5121 Missouri with the Department of Revenue. This form signifies that you please have no pending tax obligations. Ensure to follow up on the status of your application, as receiving this certificate may take several weeks depending on your situation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.