Loading

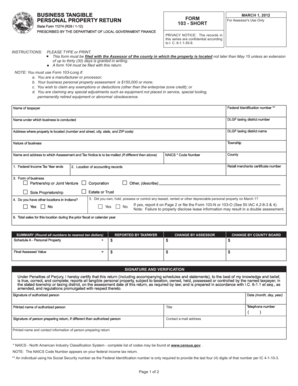

Get Indiana Form 103 Short 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana Form 103 Short 2011 online

This guide provides a comprehensive overview of how to fill out the Indiana Form 103 Short 2011 online. It is designed to assist users in accurately completing their personal property return for taxation purposes.

Follow the steps to successfully complete your form online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Enter the name of the taxpayer in the designated field. This should be the official name used for the business.

- Provide the Federal Identification number, ensuring to follow the instruction regarding the last four digits if applicable.

- Fill in the name under which the business is conducted and the DLGF taxing district number.

- Input the address where the property is located, including street number, city, state, and ZIP code.

- Specify the DLGF taxing district name and clearly state the nature of the business.

- Indicate the township and provide the name and address where the Assessment and Tax Notice should be mailed if different from the business address.

- Complete the section for the Federal Income Tax Year ends and include the NAICS code number.

- Insert the county and retail merchants certificate number if applicable.

- State the location of accounting records and select the form of business from options provided, such as corporation or sole proprietorship.

- Answer whether you have other locations in Indiana, providing details if applicable.

- Indicate if you owned or possessed any leased, rented, or depreciable personal property on March 1 and report it on Page 2 if yes.

- Enter the total sales for this location during the prior fiscal or calendar year, ensuring to round any numbers to the nearest ten dollars.

- Proceed to complete Schedule A by listing any depreciable personal property along with total costs and acquisition years.

- Finally, review all entered information for accuracy. You can then save your changes, download the form, print it, or share it as needed.

Complete your Indiana Form 103 Short online today for a streamlined filing experience.

You can order Indiana tax forms online through the Indiana Department of Revenue's website, or you can call their office for assistance. Additionally, forms, including the Indiana Form 103 Short 2011, may be available at local libraries or post offices. Ordering forms promptly can help you prepare your taxes efficiently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.