Loading

Get Filer Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Filer Form online

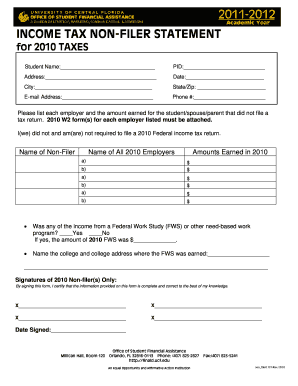

Completing the Filer Form online can be straightforward when you follow the appropriate steps. This guide will provide you with a clear understanding of each section of the form to ensure your information is accurately submitted.

Follow the steps to complete the Filer Form effectively.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- Begin by entering the student’s name in the designated field. Ensure spelling is accurate to avoid any issues with processing.

- Fill in the PID (Personal Identification) number. This is important for identifying the student in the system.

- Provide the complete address where the student resides. This must include street address, city, state, and zip code.

- Enter the email address and phone number to ensure communication regarding this form can take place.

- List each employer along with the corresponding amounts earned for the individual(s) not filing a tax return, ensuring that 2010 W2 forms are attached for verification.

- Indicate whether any income was received through a Federal Work Study or similar program. If applicable, include the amount earned.

- Specify the college name and address where the work study income was acquired.

- The non-filer(s) must provide their signatures in the space provided to certify the accuracy of the information submitted.

- Finally, confirm the date of signing before moving to save, download, print, or share the completed form.

Complete your Filer Form online today for a seamless submission experience.

Certain IRS fillable forms can indeed be filed electronically, provided they are designed for e-filing. However, not all fillable forms are eligible, so you should check the specific requirements for each form before proceeding. Using a Filer Form not only helps with filling out your forms but also guides you on the best way to submit them electronically.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.