Loading

Get Kentucky Form 8879 K

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Kentucky Form 8879 K online

Filling out the Kentucky Form 8879 K is an essential step in the electronic filing process for your individual income tax return. This guide will help you navigate each section of the form online, ensuring you complete it accurately and efficiently for successful submissions.

Follow the steps to fill out your Kentucky Form 8879 K online easily.

- Use the ‘Get Form’ button to access the Kentucky Form 8879 K and open it in your preferred online editor.

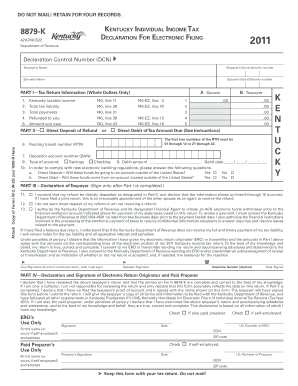

- In the upper right corner, enter the Declaration Control Number (DCN). This number must match the DCN on your federal electronic return and on federal Form 8879.

- Fill in the taxpayer's name and Social Security number. If filing jointly, include the spouse's name and Social Security number in the corresponding fields.

- In Part I, enter the required information about your Kentucky taxable income, total tax liability, total payments, any refund amount, and the amount you owe. Ensure all values are in whole dollars.

- Proceed to Part II, where you can indicate whether you prefer a direct deposit for your refund or a direct debit for any amount due. Fill out the routing transit number (RTN) and depositor account number (DAN) as per your bank details.

- Complete Part III by signing and dating the form. Ensure that the form is fully completed before signing. If filing jointly, include both signatures.

- If applicable, complete Part IV, which includes the declaration and signature of the electronic return originator (ERO) and any paid preparer involved in the filing.

- Review the entire form for accuracy one last time before saving your changes. You can then download, print, or share the completed form for your records.

Start filling out your Kentucky Form 8879 K online today to ensure a smooth filing process.

A K tax form generally refers to various forms used in Kentucky for state tax purposes. These forms include the K-1, K-2, and K-4, among others, which help residents report their income and calculate their taxes. Understanding these forms can simplify compliance and enhance your overall tax filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.