Get 2008 Oklahoma Individual Tax Return Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2008 Oklahoma Individual Tax Return Form online

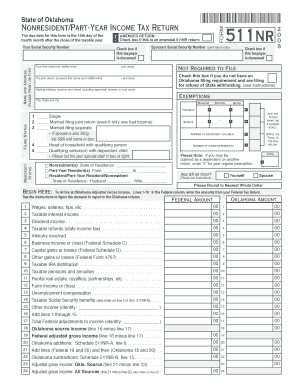

This guide provides step-by-step instructions for completing the 2008 Oklahoma Individual Tax Return Form online, specifically for nonresidents and part-year residents. By following these instructions, users can efficiently navigate through the form and ensure accurate submission.

Follow the steps to fill out the form online.

- Click the ‘Get Form’ button to obtain the 2008 Oklahoma Individual Tax Return Form and open it in an editable format.

- Begin by entering your personal information at the top of the form, including your first name, last name, Social Security number, and address. Ensure all details are accurate and formatted correctly.

- Select your filing status by checking the appropriate box, such as 'Single', 'Married filing joint', 'Married filing separate', 'Head of household', or 'Qualifying widow(er)'.

- Indicate your residency status by selecting whether you are a resident, part-year resident, or nonresident, and fill in the relevant details regarding your state of residence.

- List all sources of income in the designated sections, which may include wages, taxable interest, dividends, and other income. Be sure to accurately report amounts from your Federal return.

- Complete any adjustments for Oklahoma, including additions and subtractions as detailed in the schedules provided in the form. Make sure to include any relevant documentation.

- Calculate your Oklahoma taxable income by subtracting deductions and exemptions from your adjusted gross income, as indicated in the form.

- Refer to the Oklahoma income tax table to determine your tax based on your taxable income and fill in the relevant amount in the designated area.

- Review all entered information for accuracy, and then finalize your return by either saving, downloading, or printing the form as necessary.

- Submit your completed form according to the instructions provided at the end of the document, ensuring that it is sent to the appropriate address by the filing deadline.

Get started with your tax return today by filling out the 2008 Oklahoma Individual Tax Return Form online.

Filing returns for individuals requires careful preparation of necessary forms and documentation. For the 2008 Oklahoma Individual Tax Return Form, gather your income statements like W-2s and 1099s, deductibles, and credits. You can choose to file electronically for convenience or print and mail your forms. Utilizing platforms like US Legal Forms can streamline the process, providing guidance and ensuring compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.