Loading

Get Tc 721g

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 721g online

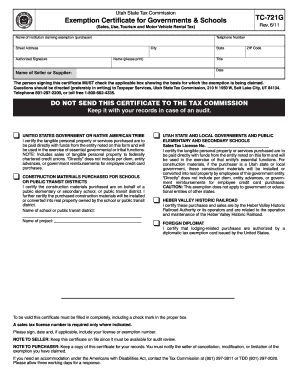

The Tc 721g is an exemption certificate designed for governments and schools to claim tax exemptions. This guide will provide you with a clear and concise step-by-step process for completing the Tc 721g form online, ensuring an accurate submission.

Follow the steps to successfully complete the Tc 721g.

- Click ‘Get Form’ button to access the Tc 721g form and open it in the designated editor.

- Begin by entering the name of the institution claiming the exemption in the provided field.

- Fill in the telephone number of the institution. Ensure it is accurate for any follow-up communications.

- Provide the complete street address of the institution, including city, state, and ZIP code.

- The next section requires an authorized signature. A representative from the institution should sign here.

- Print the name of the signatory clearly in the field provided.

- Indicate the title of the person signing the form to clarify their authority.

- Date the form in the specified field to document when the exemption certificate was completed.

- Enter the name of the seller or supplier to whom the form is being issued.

- Select the appropriate exemption basis by checking the applicable box (e.g., United States government, construction materials for schools, etc.).

- If applicable, fill in the sales tax license number where indicated.

- Once all sections are completed and reviewed, save changes to your document. You can also download, print, or share the completed form as necessary.

Begin filling out your Tc 721g form online today!

In Utah, the frequency of sales tax filing depends on your total taxable sales. Generally, if your sales exceed $500,000 annually, you must file monthly. For businesses with sales between $100,000 and $500,000, quarterly filing is required. If you have lower sales, you can file annually. Keeping up with these requirements is crucial, and using tools like the Tc 721g can help you manage your sales tax obligations effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.