Loading

Get Mo 1120es Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mo 1120es Form online

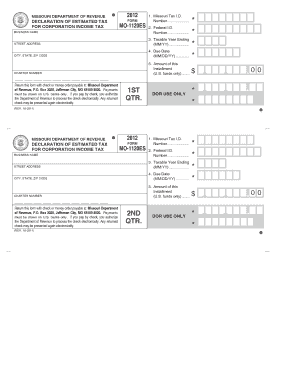

Filling out the Mo 1120es Form online can streamline the process of submitting estimated tax payments for corporations in Missouri. This guide provides step-by-step instructions to help users complete the form efficiently and accurately.

Follow the steps to complete the Mo 1120es Form online effectively.

- Click ‘Get Form’ button to access the Mo 1120es Form and open it in your preferred document editor.

- Enter the Missouri Tax I.D. Number in the designated field at the top of the form. Ensure that this number is accurate to avoid any processing errors.

- Input the Federal I.D. Number in the appropriate section. This information is vital for the identification of your business.

- Complete the street address where your business is located. Be sure to provide the full address including city, state, and ZIP code.

- Specify the taxable year ending date in the format MM/YY. This indicates the fiscal timeline for your corporation.

- Fill in the due date of the installment payment in MM/DD/YY format to ensure timely submission.

- Enter the amount of this installment payment in U.S. funds only. Make sure to round to the nearest whole dollar as specified.

- Review all entered information for accuracy to prevent any discrepancies.

- Save the changes made to the form. You may download, print, or share the form as needed for record-keeping or submission.

Complete your Mo 1120es Form online today to ensure your corporation meets its tax obligations.

Yes, it’s essential to include a copy of your federal return when filing the Mo 1120es Form for Missouri. This helps the state verify your reported income and ensures consistency between federal and state filings. Taking the time to prepare your documents correctly will help avoid issues down the line.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.