Loading

Get Form 285

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 285 online

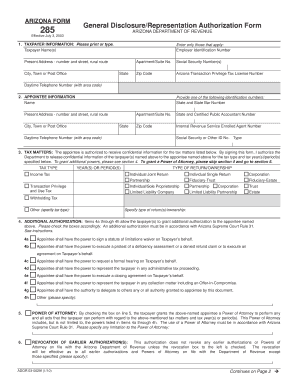

Filling out Form 285, the General Disclosure/Representation Authorization Form, is an important step in authorizing an appointee to handle tax matters on your behalf. This guide provides clear and supportive instructions for completing the form online, ensuring you can navigate each section with confidence.

Follow the steps to fill out the Form 285 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section 1, Taxpayer Information. Enter the names of the taxpayer(s), including their Employer Identification Number, current address (including apartment/suite number, city, state, and zip code), Social Security Numbers, and their Arizona Transaction Privilege Tax License Number, along with a daytime telephone number.

- Move on to Section 2, Appointee Information. Fill in the name of the appointee and provide one of the following identification numbers: State Bar Number, CPA Number, or IRS Enrolled Agent Number. Include the appointee's address, zip code, and daytime telephone number.

- In Section 3, Tax Matters, identify which tax matters the appointee is authorized to receive confidential information for. Check the relevant tax types, specify the years or periods applicable, and indicate the type of return or ownership.

- Proceed to Section 4, Additional Authorization. Check the boxes for the additional powers you want to grant the appointee. This may include powers such as signing waivers or representing you in hearings.

- In Section 5, Power of Attorney, check the box to grant the appointee the Power of Attorney to perform all acts related to the tax matters specified. You may specify any limitations to this power.

- Section 6 allows you to revoke any previous authorizations. If applicable, check the box to revoke earlier documents and specify any that should remain valid.

- In Section 7, corporations with controlled subsidiaries must provide details if applicable, including checking whether to include all subsidiaries or exclude specific ones.

- Complete Section 8 by signing and dating the form. Ensure you have the authority to provide this authorization.

- Optionally, complete Section 9 if the appointee has been given authority under previous sections. Sign and date this declaration.

- Once all sections are filled, you can save changes, download, print, or share the completed form.

Complete the Form 285 online today to ensure your tax matters are handled efficiently.

Related links form

To get tax forms in Canada, visit the Canada Revenue Agency’s official website. They offer various tax forms for individuals and businesses, including downloadable PDFs. You can also order printed copies to be sent to your address. Accessing these forms allows Canadian residents to fulfill their tax obligations just like you would with Arizona Form 285.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.