Loading

Get Form 8892 Instructions

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8892 Instructions online

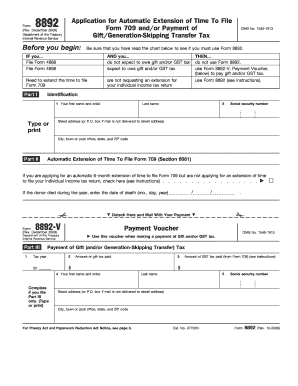

Filling out the Form 8892 is essential for requesting an automatic extension of time to file Form 709 and managing associated gift tax payments. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to successfully fill out the Form 8892 Instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, fill in your identification details, including your first name, last name, social security number, and street address or P.O. box. Be sure to provide the city, state, and ZIP code.

- Proceed to Part II to apply for an automatic 6-month extension for filing Form 709. Check the designated box if you are not requesting an extension for your individual income tax return.

- If the donor passed away during the year, enter the date of death in the space provided as part of your application in Part II.

- If you are making a payment alongside your extension request, complete Part III, specifically filling out boxes 1, 2, and 3, which pertain to the amounts due.

- Make your check or money order payable to ‘United States Treasury’ for any payments. Enclose it with the completed payment voucher and do not staple them together.

- Once all sections are completed, review your entries for accuracy, then save changes, download, print, or share the form as needed.

Complete your Form 8892 online today for an efficient filing experience.

Related links form

To fill out a W-4 for the biggest refund, consider your estimated tax liability and personal circumstances. Claiming fewer allowances can increase your withholding, leading to a potentially larger refund. The Form 8892 Instructions explain how these choices impact your tax situation. Additionally, using platforms like UsLegalForms can help streamline this process and ensure accuracy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.