Loading

Get Mn Rev184a Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Mn Rev184a Form online

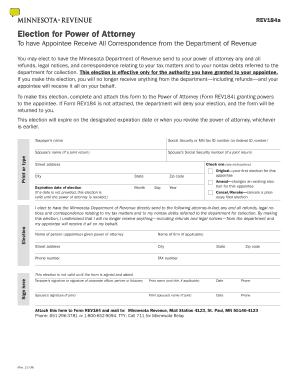

Filling out the Mn Rev184a Form online can streamline your tax communication and ensure that your designated representative receives all relevant information. This comprehensive guide will take you through each section of the form to ensure clarity and completeness.

Follow the steps to complete the Mn Rev184a Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editing environment.

- Begin by entering the social security number or Minnesota tax ID number (or federal ID number) in the designated field to identify your tax record.

- If you are filing a joint return, provide your spouse’s name and social security number in the appropriate sections.

- Fill in your name, street address, city, state, and zip code. Ensure that these details are accurate to avoid any complications.

- Specify the expiration date of election. If a date is left blank, the election will remain valid until revoked.

- Select the appropriate option to indicate whether this is your original election for the appointee, an amendment to an existing election, or a cancellation of a previous election.

- In the election statement, affirm your decision to allow the Minnesota Department of Revenue to send all correspondence and refunds directly to the appointee.

- Input the name of the person (appointee) who is given the power of attorney, along with their firm name, if applicable.

- Provide the street address, city, state, zip code, and phone number of the appointee.

- Sign and date the form, making sure your signature is legible, and include your printed name. If applicable, a corporate officer or partner should include their title.

- If applicable, your spouse must also sign and date in the designated areas for joint filings.

- Once complete, save your changes and download or print a copy of the form for your records.

- Attach this form to Form REV184 and prepare to mail it to the address provided: Minnesota Revenue, Mail Station 4123, St. Paul, MN 55146-4123.

Complete your documents online today for a smooth filing process.

Yes, Minnesota has a state income tax form that residents must use to report their income to the state. This form is an essential document in the tax filing process, and the Mn Rev184a Form is among the various forms you may need. To quickly find and fill out your tax documents, consider utilizing resources like USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.