Loading

Get Uaccm 1098t

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Uaccm 1098t online

Filling out the Uaccm 1098t form online can be a straightforward process if you have the proper guidance. This guide provides step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the Uaccm 1098t online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editing platform.

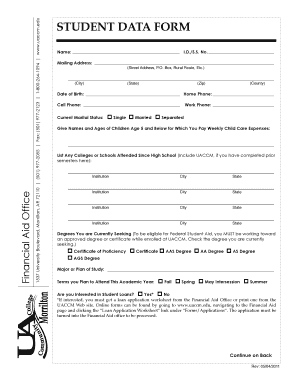

- Begin by entering your personal information in the designated fields, including your full name, identification number (ID or Social Security Number), and mailing address.

- Fill out your date of birth and contact numbers, including home and cell phone details.

- Indicate your current marital status by selecting the appropriate checkbox for Single, Married, or Separated.

- If applicable, list the names and ages of any children aged five and below for whom you pay weekly child care expenses.

- Provide information about any colleges or schools you have attended since high school, ensuring to include UACCM if you have completed any semesters there.

- Select the degrees you are currently seeking by checking the appropriate box for your desired certificate or degree program.

- Outline your major or plan of study in the provided text box.

- Indicate the terms you plan to attend in the academic year by selecting the appropriate checkboxes for Fall, Spring, May Intersession, or Summer.

- State your interest in student loans by selecting yes or no. If yes, be aware of the requirement to obtain a loan application worksheet.

- Authorize UACCM to apply any Federal Title IV funds to your account for educational costs by selecting yes or no.

- Read the statement of educational purpose and certification statements regarding overpayments and defaults, and confirm your understanding.

- Certify your registration status with Selective Service and choose the appropriate options per your status.

- Complete the Family Education Rights and Privacy Act (FERPA) section, indicating who can discuss your records with the financial aid staff.

- Sign and date the document, ensuring to indicate if you are incarcerated as required by the form.

- After completing all sections of the form, review your answers for accuracy. Once confirmed, save the changes, download, print, or share the finished form as needed.

Complete your Uaccm 1098t form online today and ensure a smooth submission process.

If your school fails to provide a Uaccm 1098-T form, you may face difficulties claiming education tax credits or deductions. It is important to communicate directly with your institution’s financial aid office to discuss your situation. They can explain the reasons and provide alternatives. Additionally, platforms like UsLegalForms can help you understand your rights and options for obtaining needed tax documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.