Loading

Get Software For Form Pt 100 Nys Petroleum Tax Returns

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

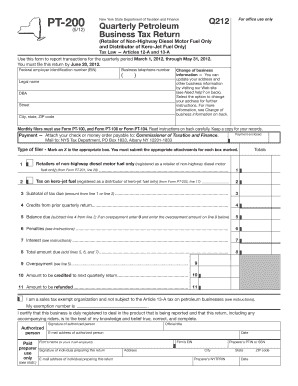

How to use or fill out the Software For Form Pt 100 Nys Petroleum Tax Returns online

Filling out the Software For Form Pt 100 Nys Petroleum Tax Returns can be a straightforward process when you follow a structured approach. This guide provides a step-by-step walkthrough to help users successfully complete the form online.

Follow the steps to fill out your Form Pt 100 online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review your legal name and complete mailing address on the form. Ensure the information is correct. If it’s not preprinted or needs an update, make the necessary changes.

- Identify your type of filer by marking an X in the appropriate box for either retailer of non-highway diesel motor fuel or distributor of kero-jet fuel. Be sure to attach the relevant forms as specified.

- Calculate the tax due based on the selected type of filer. Enter the appropriate amounts from Forms PT-201 or PT-202 as needed.

- Determine your total tax due by subtotaling the amounts from lines 1 and 2, and subtract any credits claimed from prior returns.

- If there’s a balance due, calculate penalties and interest as per the instructions provided. Add all amounts on lines 5, 6, and 7 to determine the total amount due.

- If you have an overpayment, enter it on line 9. Specify the amount you wish to credit to your next return on line 10, and the refund amount on line 11.

- Ensure the form is signed and dated by the authorized individual or paid preparer, including their contact information.

- Review the completed form for accuracy and completeness before proceeding to save changes, download, print, or share your form.

Don't hesitate to complete your forms online for a more efficient filing process.

While electronic filing for New York State taxes is not mandatory for everyone, it is highly encouraged for its efficiency and accuracy. Using Software For Form Pt 100 Nys Petroleum Tax Returns allows users to file electronically, which is not only faster but also reduces common errors associated with paper filing. Many find that this method simplifies the process and provides immediate confirmation of submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.