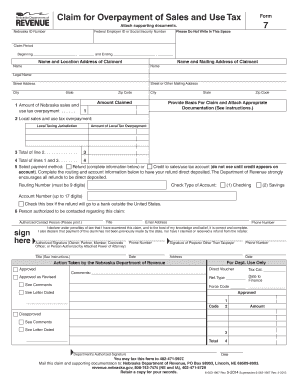

Get Nebraska Form 7 Claim For Overpayment Of Sales And Use Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nebraska Form 7 Claim For Overpayment Of Sales And Use Tax online

Filing a Claim for Overpayment of Sales and Use Tax in Nebraska is a straightforward process designed to assist individuals who have overpaid their sales taxes. This guide provides comprehensive, step-by-step instructions for completing the Nebraska Form 7 online, ensuring that you can navigate the form with confidence.

Follow the steps to successfully complete your claim.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your Nebraska ID number and Federal Employer ID or Social Security Number in the appropriate fields.

- Indicate the claim period by providing the beginning and ending dates of the overpayment.

- Complete the section for your name and mailing address, ensuring to include your legal name, street address, city, state, and zip code.

- In the first line, enter the amount of Nebraska sales and use tax overpayment you are claiming.

- Calculate the total of the local overpayment and add it to the state overpayment. Enter this amount in the total line.

- Select your preferred payment method. You can choose between a refund or a credit to your sales/use tax account. If you opt for direct deposit, complete the routing and account number information.

- Designate an authorized contact person for this claim by providing their name, email address, and phone number.

- Ensure all necessary signatures are provided. The claim must be signed by the owner, partner, or corporate officer. If someone else is signing, include a power of attorney.

- Review the completed form for accuracy, attach any necessary supporting documents, and save your changes.

- Finally, download, print, or share the completed form as necessary. You may also fax it or mail it to the Nebraska Department of Revenue at the provided address.

Start your claim process online today to manage your sales tax overpayments effectively.

In Nebraska, the sales tax and use form is used to report and remit sales tax collected from customers. Businesses must file this form regularly to comply with tax laws. Additionally, you can file a Nebraska Form 7 Claim For Overpayment Of Sales And Use Tax if you believe you have overpaid sales tax. Properly managing this form is crucial for maintaining tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.