Get Form Aa For Web.qxp - Opers - Opers

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form AA For Web.qxp - OPERS - Opers online

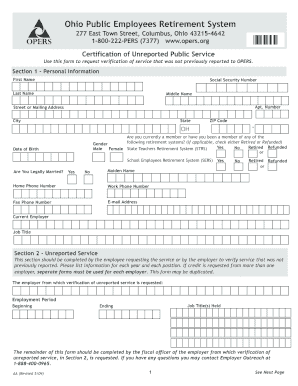

Filling out the Form AA for the Ohio Public Employees Retirement System is an essential process for users seeking verification of unreported public service. This guide will provide detailed instructions for completing each section of the form accurately and efficiently.

Follow the steps to complete the Form AA for OPERS online.

- Click the ‘Get Form’ button to obtain the form and open it in your document editor.

- In Section 1 - Personal Information, provide your first name, last name, middle name, and social security number. Fill in your address details, including city, state, and ZIP code.

- Indicate whether you are a member or have previously been a member of any retirement systems by checking either 'Retired' or 'Refunded'. Also specify your gender and complete your contact information including phone and email.

- In Section 2 - Unreported Service, list each employment period, job titles held, and the employer from whom you are requesting verification. Be sure to document the necessary details for every year and position.

- Section 3 - Employer Information must be completed by the employer's fiscal officer. They will certify the unreported earnings and any additional service.

- Section 4 - Employer Certification requires the fiscal officer to certify the unreported service based on their records. They must indicate the cause of any retirement contributions not made.

- Lastly, ensure all fields are completed, save your changes, and review the form before downloading, printing, or sharing it.

Complete your Form AA for OPERS online today to ensure your service is verified.

Whether OPERS provides enough income for retirement depends on your individual financial situation and retirement goals. OPERS benefits, combined with other savings and investments, often create a more secure retirement plan. Many individuals find that considering Form AA For Web.qxp - OPERS - Opers helps them assess their overall readiness for retirement. Evaluating your financial landscape with a retirement advisor can also aid in making informed decisions about your future.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.