Get Form M 8453p Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form M 8453p Instructions online

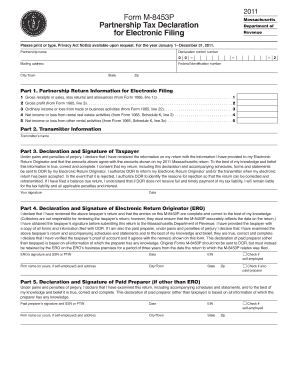

This guide provides a clear and comprehensive overview of how to fill out the Form M 8453p for electronic filing. By following the steps outlined below, users will be able to complete the necessary information accurately and efficiently.

Follow the steps to complete the Form M 8453p online.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Begin by filling in the partnership name in the designated field at the top of the form.

- Enter the declaration control number, which is specific to your filing, followed by the mailing address of the partnership.

- Input the federal identification number in the provided section as this is crucial for identification purposes.

- In Part 1, provide the gross receipts or sales amount from Form 1065, line 1c, in the first field. Follow with the gross profit from Form 1065, line 3, in the second field.

- Continue with the ordinary income or loss from business activities, which is found on Form 1065, line 22, and enter this amount in the appropriate section of Part 1.

- Next, report net income or loss from rental real estate activities, which is derived from Form 1065, Schedule K, line 2, in the following field.

- Complete the section by entering the net income or loss from other rental activities, referenced from Form 1065, Schedule K, line 3c.

- Proceed to Part 2 and fill out the transmitter's name to specify who is managing the electronic submission.

- In Part 3, ensure the taxpayer's signature is obtained, along with the date, confirming that the information provided is accurate. It's essential that this declaration is complete.

- If applicable, in Part 4, the Electronic Return Originator (ERO) should provide their signature, SSN or PTIN, and date. Include the firm name or individual name if self-employed.

- Finally, review all sections for accuracy. Save your changes, and when you're finished, you can download, print, or share the form as needed.

Complete your Form M 8453p online today to ensure a smooth electronic filing experience.

You can conveniently order Alabama tax forms through the Alabama Department of Revenue's website. They provide options for downloading forms directly or ordering printed versions to be mailed to you. For added convenience, consider utilizing platforms like USLegalForms, which streamline the process of obtaining various state tax forms and can help you through the complexities of state tax filings, including necessary instructions.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.