Loading

Get Ky Form 8453 K

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ky Form 8453 K online

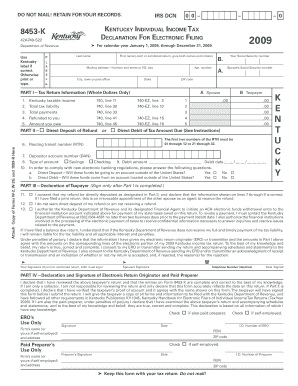

Filling out the Ky Form 8453 K is an essential step for individuals filing their Kentucky individual income tax return electronically. This guide provides step-by-step instructions to ensure that users can complete the form accurately and efficiently.

Follow the steps to complete your Ky Form 8453 K online.

- Click ‘Get Form’ button to obtain the form and open it in the editor, allowing you to access the necessary fields to fill out your tax information.

- Enter your last name, first name, mailing address, and Social Security number accurately in the designated fields.

- Complete Part I by entering the required tax return information, including your Kentucky taxable income, total tax liability, total payments, any refund you are owed, or the amount you owe.

- In Part II, choose whether you want your refund directly deposited or if you prefer a direct debit for any amounts due. Provide the necessary bank account information, including the routing transit number and depositor account number.

- In Part III, review your information carefully. Sign the form only after all sections are complete and ensure any joint filers also provide their signature.

- If applicable, complete Part IV with the declaration and signature of the electronic return originator (ERO) or paid preparer. Make sure all signatures are collected before submitting.

- After confirming all details, save your changes, and ensure you do not mail the form as it must be retained for your records.

Complete your forms online today to ensure a smooth filing process.

A K tax form generally refers to forms used in Kentucky for various tax purposes, including the Ky Form 8453 K. These forms help taxpayers report specific income and deductions to the state. Understanding the different K forms can help you navigate your tax obligations more effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.