Loading

Get Form 50 001 10

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 50 001 10 online

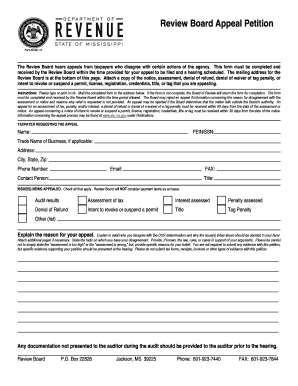

Filing Form 50 001 10 is an important step for taxpayers wishing to appeal decisions made by the Review Board. This guide will provide you with clear instructions on how to complete the form accurately and submit it in a timely manner.

Follow the steps to fill out the Form 50 001 10 correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide your name in the designated field, along with your FEIN or SSN. If applicable, enter your trade name of business.

- Enter your complete address, including city, state, and zip code. Include a valid phone number, email address, and FAX number if available.

- Identify a contact person and their title in the respective fields.

- In the 'ISSUE(S) BEING APPEALED' section, check all applicable boxes. Remember, the Review Board will not consider payment terms as an issue.

- In the space provided, explain the reason for your appeal in detail. Clearly state why you disagree with the agency's determination, including specific reasons and relevant laws or rules. You can attach additional pages if more space is needed.

- List each tax account number related to your appeal in the 'Tax Information' section, including the amounts contested and the corresponding tax periods.

- State the decision you are requesting from the Board, in the designated area.

- If you are represented by another party, indicate this by checking 'Yes' and complete the representative's information including name, firm, address, and contact details.

- Finally, read the certification statement carefully, sign the form, and include the date of signing.

- You can now save your changes, download the completed form, print it for mailing, or share it as necessary.

Complete your appeal process efficiently by filling out form 50 001 10 online.

The W-8BEN is filled out by non-U.S. individuals or entities who receive income from U.S. sources. By completing this form, they can claim beneficial tax rates according to tax treaties. Using resources like uslegalforms simplifies this process, especially in relation to Form 50 001 10.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.