Get Texas Unemployment Benefits Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Texas Unemployment Benefits Application Form online

Filling out the Texas Unemployment Benefits Application Form can be a straightforward process when you understand each section and field. This guide provides clear, step-by-step instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete your application online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

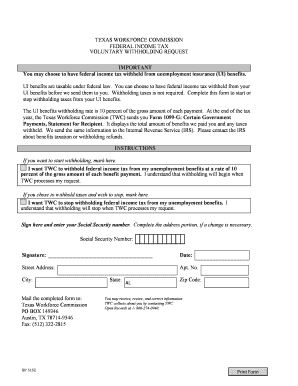

- Review the top section to understand the importance of withholding federal income tax from your unemployment insurance benefits. Decide whether you want to start or stop withholding taxes and mark the appropriate option.

- If you choose to start withholding, you must mark that option and confirm you understand withholding will begin once TWC processes your request.

- If you wish to stop withholding taxes, select that option, and acknowledge that withholding will cease when TWC processes your request.

- Sign the form to verify your request, and enter your Social Security number in the designated field.

- Complete your address information, ensuring all details are accurate, especially if there are any changes.

- Once you have filled out the form, review all entries for accuracy before finalizing.

- Save changes, download a copy of the completed form, and if necessary, print it for your records.

- Mail the completed form to the Texas Workforce Commission at the provided address, or fax it to the specified number.

Take the next step towards securing your unemployment benefits by completing the form online today.

To apply for unemployment benefits in Texas, you need to prepare several documents, including your Social Security number, a driver's license or state ID, and your work history for the past 18 months. This information is crucial when completing the Texas Unemployment Benefits Application Form. Having this ready will streamline your application process and help you receive your benefits faster. You can always rely on user-friendly platforms like uslegalforms to assist you in this process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.