Get Form Ct 8508

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form CT-8508 online

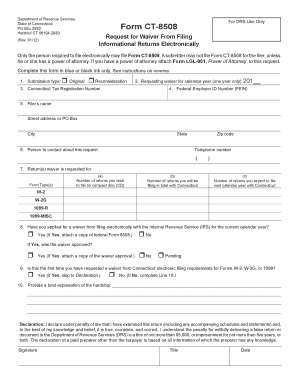

Filling out the Form CT-8508 online is an essential step for individuals required to request a waiver from filing informational returns electronically. This guide aims to provide clear and user-friendly instructions to assist you through each section of the form.

Follow the steps to complete the Form CT-8508 online.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, select the submission type by checking either 'Original' for your first request or 'Reconsideration' if you are providing additional information for a previous denial.

- Enter the calendar year for which you are requesting the waiver in the designated field.

- Provide your Connecticut Tax Registration Number in the appropriate box.

- Input your Federal Employer Identification Number (FEIN) in the specified area.

- Fill in the contact information, including the name, street address or PO Box, city, state, and zip code for the filer.

- Enter the name and telephone number of the person to contact about the request.

- For line 7, specify the return types for which the waiver is requested, along with the number of returns you intend to file in the respective columns.

- Indicate whether you have applied for a waiver from the IRS for the current calendar year and attach any required documentation, such as federal Form 8508.

- If this is not your first request for a waiver, provide a brief explanation of the hardship that electronic filing would cause.

- Complete the Declaration section by signing the form, including your title and the date.

- Finally, save your changes, and prepare to download, print, or share the completed form as needed.

Start filling out your Form CT-8508 online today to ensure compliance with Connecticut's filing requirements.

To register for CT withholding tax, you need to complete the appropriate registration form available on the Connecticut Department of Revenue Services website. For some cases, you may need to submit Form CT 8508 as part of your registration process. This form helps ensure compliance with state tax obligations. If you are unsure about the steps, the USLegalForms platform can assist you in completing this registration smoothly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.